Calculator

IT Park vs SRL

Frequently Asked Questions (FAQ)

💡 Being an IT Park resident means your company operates under a special tax regime with simplified administration and a single 7% tax on revenue. Unlike a standard LLC, where you pay separate taxes (social contributions, medical insurance, corporate income tax, etc.), in IT Park these are effectively bundled into one unified tax. The goal of this regime is to encourage IT development and attract investment into the sector.

In general, this regime is most beneficial for companies with a relatively high monthly revenue per employee, roughly above EUR 3,600 per month per employee. This is because the unified tax rate is 7%, but there is also a minimum tax threshold.

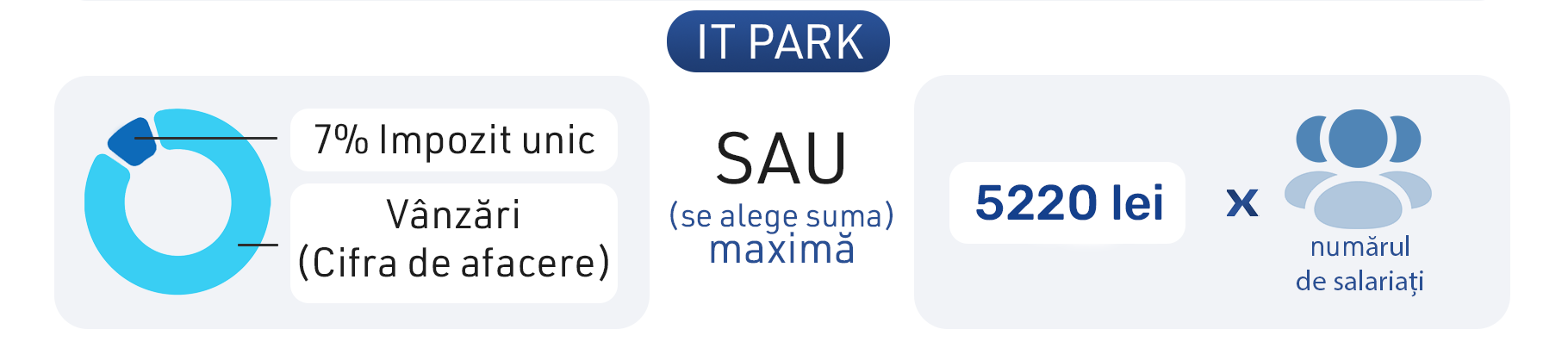

The company pays 7% of monthly revenue or 5,220 MDL per employee (which represents 30% of the average salary in the economy, assumed at 17,400 MDL for 2026) – whichever amount is higher.

Example:

Assume the company has one employee and different revenue levels:

- a) Monthly revenue is 100,000 MDL. 7% = 7,000 MDL. This is higher than 5,220 MDL, so the company pays 7,000 MDL.

- b) Monthly revenue is 40,000 MDL. 7% = 2,800 MDL, but the minimum per employee is 5,220 MDL. In this case, the company pays 5,220 MDL, which is effectively about 12% of revenue, not 7%.

To obtain resident status, a company must operate in IT, creative industries or research & development, so that at least 70% of its revenue comes from these activities. Examples of eligible activities include:

- Custom software development, including programming, modification, testing and support;

- Data processing and website administration;

- Production and publishing of software products (apps, games, operating systems);

- Technology consulting and IT infrastructure management;

- Call center and outsourcing services, mainly for export;

- Production of high-performance hardware;

- Specialised design based on powerful hardware (e.g. 3D, CAD, rendering);

- Operating web portals.

For the full list of eligible activities, check the legislation (Law no. 77/2016 on IT parks) or visit the official Moldova IT Park (MITP) website.

The registration process is relatively straightforward and includes a few key steps:

- Set up an SRL/LLC (if you don’t already have one);

- Obtain a valid electronic signature;

- Submit the online application on the official Moldova IT Park platform.

Once approved, you will receive official resident status and start benefiting from the tax and administrative advantages of the IT Park regime.

| Aspect | IT Park | SRL / LLC (standard regime) |

|---|---|---|

| Tax type | Single tax of 7% on revenue, but not less than 30% of the average salary in the economy × number of employees. | Corporate income tax (4% of revenue for non-VAT payers, 12% of profit for VAT payers), social security contributions (24%), medical insurance (9%) and other taxes, each calculated and reported separately. |

| Administrative complexity | Simplified: one unified tax (7%). | More complex: multiple declarations and payments for each tax and contribution. |

| Social benefits | The total tax on the payroll is effectively fixed at regime level, not directly linked to whether you pay 10,000 or 100,000 MDL net to a specific employee. Separate social contributions are not calculated on top – they are covered by the unified tax. | Benefits and contributions are calculated on the real gross salary declared. The higher the salary, the higher the total tax and contributions. |

If less than 70% of your revenue comes from eligible IT/creative activities, your company risks losing its IT Park resident status and, therefore, the right to apply the 7% unified tax and related benefits.

It depends on the turnover. If a company’s taxable turnover for the last 12 consecutive months exceeds 1.5 million MDL, it is required to register as a VAT payer – regardless of whether it is in IT Park or not.

After VAT registration:

- If services are supplied in the Republic of Moldova, the company charges and pays VAT.

- If services are exported (clients abroad), those services are generally not subject to Moldovan VAT.

As an employee of an IT Park resident, you usually receive the agreed net salary, while the company pays the 7% unified tax on its overall revenue, instead of separate payroll taxes and contributions based directly on your gross salary.

In the classic system, taxes and contributions are withheld from your gross salary and you only see the remaining net. In IT Park, you know from the start what you get “in hand”, while the tax burden sits on the company’s side. Moreover, the unified tax does not increase linearly with each individual salary, which is particularly attractive for highly paid IT specialists.

Overall, IT Park companies tend to work transparently, offer legal, stable contracts and are oriented towards long-term collaboration.

The IT Park regime currently has a validity period set by law, but the general expectation is that it will be extended. Rules can change over time, but in practice changes are usually announced in advance, giving companies time to adjust.

Annual audit for IT Park residents is explicitly required by Law no. 77/2016 on IT Parks. Its purpose is to verify the correct calculation and payment of the unified 7% tax, which replaces several other standard taxes.

This ensures transparency, trust in the regime and confirms that the company is not abusing the tax advantages.

For all IT Park residents – regardless of number of employees, turnover or asset size – audit remains mandatory and is part of the contractual obligations towards the IT Park Administration (MITP).

Audit is usually required in two situations:

- Annual statutory audit – after year-end, generally by 30 April of the following year;

- Upon termination of the residency contract – after receiving the decision regarding exit from IT Park.